DAILY DIGITAL PULSE OF CHINA: ARCHIVE

Fri

29

Apr

2022

ALDI Shanghai grocery care packages delivered during ongoing China Covid lockdowns

Wed

11

Nov

2020

Web2Asia client Uncle Buds launches its CBD brand on Tmall Global with Magic Johnson livestream!

Mon

13

Jul

2020

Web2Asia once more awarded 5 Star Tmall Partner by Tmall Global

Web2Asia has been awarded 5 Star Tmall Partner (TP) by Tmall Global for the year 2020. This is the highest certification level for Alibaba Partners. We are extremely thankful for our clients' and Alibabas' trust to allow this recognition.

Mon

02

Dec

2019

Web2Asia awarded TOP 3 Tmall Partner by Tmall Global during 11.11. Singles Day 2019

Thu

22

Mar

2018

March 22nd 2018 News: dm drogerie markt Tmall Global shop recognized as the 2017 Super Brand

Read MoreSat

22

Jul

2017

Alibaba produces Jellycat & Web2Asia Tmall Global success case study video

Watch how Web2Asia is helping British toy brand Jellycat with its flagship store at jellycat.tmall.hk to sell via cross-border E-Commerce directly to Chinese consumers. Jellycat has now achieved no 1 position in the entire Alibaba Tmall and Taobao plush toy category. This case study video on Jellycat's succes on Tmall Global was produced and published by Alibaba Group at http://www.alizila.com/video/worlds-squidgiest-toy-comes-china/.

Wed

19

Apr

2017

Web2Asia attends 2017 Alibaba Global Partners Summit with 5 key account clients, wins award for Hansgrohe top brand of 2016

Our team attended the Alibaba 2017 Global Partners Summit in Hangzhou this April 18th 2017.

The event was a high level gathering of only C-Suite level representatives from Tmall Global key account brand clients and Tmall Partners ("TP's") respectively.

Web2Asia attended as Tmall Partner, representing five of it's Tmall Global key account clients:

- Hansgrohe

- dm-drogerie markt

- Jellycat

- Bellroy

- METRO Group

Congratulations go to our client Hansgrohe for winning the most popular brand of 2016 award. Pictured to the left is Web2Asia CEO George Godula and Thomas Stopper who is responsible for all E-Commerce, Sales and Finance for Hansgrohe in Mainland China and Macao.

Below a picture gallery with further impressions from the event. Pictured are among others Alvin Liu, CEO Tmall Global, representatives from METRO, jellycat and dm-drogerie markt.

Mon

06

Mar

2017

Web2Asia launches dm-drogerie markt on Alibaba Tmall Global

Today marks the flagship store Grand Opening of German drug store dm-drogerie markt on Alibaba's Tmall Global platform. Web2Asia worked for over one year in preparation of the launch together with dm, it's German agency oddity as well as Alibaba Tmall and Cainiao. Already in the soft-launch phase from December 2016 to February 2017 the flagship store became the largest German drug store on Tmall in terms of monthly Gross Merchandise Volume (GMV).

The store currently features dm's private label brands Balea, DONTODENT, Prinzessin Sternenzauber and DAS gesunde PLUS in the categories of cosmetics, dental care as well as children's personal care and health supplements respectively. dm is also one of total only three officially authorized resellers of Aptamil instant formula, which now is also made available to Chinese consumers via cross-border E-Commerce and with highest German quality standards.

About dm-drogerie markt

dm-drogerie markt is a chain of retail stores headquartered in Karlsruhe, Germany that sells cosmetics, healthcare items, household products and health food. With 38,890 employees, 1,825 stores and approx. 7.5 billion EUR in revenues in Germany, dm is Europe's largest retailer in the drug store category.

About Web2Asia

Web2Asia is an award winning China Digital Agency and E-Commerce Operation company. It works with foreign brand clients to setup shops on the major Chinese online marketplaces and maintain them with a full-service solution. Web2Asia is star-rated Tmall Partner ("TP") and recommended by Tmall Global.

Thu

02

Mar

2017

Goldman report: China Online Shopping to double in size to $1.7 trillion by 2020

Fri

09

Oct

2015

China Daily Digital Pulse: Tmall Global to launch O2O offline retail stores

China E-Commerce

Tmall Global to launch O2O retail stores

Interesting developments in the China cross-border e-commerce market: Tmall Global will launch 23 offline stores in Hangzhou as an initial test run. The stores will offer a mix of approx. 70% immediately available imported products as well as 30% of inventory through O2O cross-border shipped foreign products. The offline retail expansion will be in cooperation with Chinese department store operator Intime Retail Group - one of Alibaba's 2014 investments into brick & mortar retailing.

Web2Asia is excited to have one of our clients participate in the first roll-out and are looking forward to sharing further updates.

Source: ebrun

Mon

21

Apr

2014

Daily Digital Pulse of China: Alibaba, Alipay, The Vatican, M-Commerce, and Weibo

China E-Commerce

Alibaba to Start Telecom Services in China

Alibaba, China’s biggest e-commerce group, will be launching Chinese telecom services in June. The company received China’s first mobile virtual network operating licenses late last year. The exact details of the services will remain under wraps, but it has been reported that Alibaba has coordinated with China’s major telecom companies – China Mobile, China Telecom, and China Unicom – to offer the ultimate services to millions of mobile users. Alibaba is actually among 11 companies approved by Chinese regulators to operate virtual network in China.

Source: Wall Street Journal

China E-Commerce

Alipay Moves Beyond Alibaba with Rakuten

Last week, Rakuten, one of the main e-commerce players in Japan, started accepting Alipay payments, making life much easier for Chinese consumers to take advantage of the Japanese international marketplace.

Rakuten’s Japanese marketplace is massive, with 42,000 sellers, while its international one (Rakuten Global) is still relatively small, with about 10,000 sellers. At this moment of time, only about 250 sellers on Rakuten Global accept Alipay, but eventually all Rakuten sellers who ship to China will be accepting Alipay.

Source: China Topix

Tue

15

Apr

2014

Daily Digital Pulse of China: Online Shopping,

China E-Commerce

14% of Chinese Shop Online Everyday

According to a report created by PricewaterhouseCoopers, 14% of Chinese respondents shop online daily. Over 60% claim to shop online at least once a week, which is much higher than the global average of just 5% who shop online everyday and 21% every week. When it comes to mobile shopping, Chinese consumers ranked first, with 4% of respondents shopping via mobile everyday, 20% using it once a week, and 27% once a month. The global percentages are 2%, 7%, and 12%, respectively.

Source: China Internet Watch

China E-Commerce

Chinese online market revenue and mobile users increase exponentially

The Ministry of culture today released a report stating that the popularity of mobile Internet and more specifically online music increased remarkably. Market revenue of China’s online music business reached 7.41 Billion Yuan, an increase of 63.2% since 2012, while the online music market increased 140% to 4.36 Billion Yuan.

Of particular interest were the online user figures. The number of online users only increased by 4.6% to 450 million people, however the number of mobile music users grew 203% from 96 million to 291 million, highlighting the huge move towards mobile Internet usage. Although the report sounds promising there were still problems regarding network efficiency, which plagued the development of the music industry, but the Ministry of Culture has said they will focus on improving policies and regulations to progress the integrity and effectiveness of the system in order to promote continued prosperity and healthy development.

Source: Alibuybuy

China E-Commerce

China Overtakes the U.S. as the Biggest Online Spenders

The Chinese e-commerce industry is predicted to be worth $541 billion USD by the year 2015. In fact, 49% of the population made an online purchase last year, a figure that is meant to increase to 71% by 2017. The demographic of the Chinese online consumer is comprised primarily of younger people, with 60% of the consumers under the age of 30. They are also considered to be affluent – online spending is highest in China’s tier one cities, and those earning more than 5,000 RMB per month are likelier to make online purchases. The market is also dominated by mobile devices, with 464 million of its 591 million internet users opting to use their smartphones or mobile devices to surf the web.

Source: The Future of Commerce

China E-Commerce

LinkedIn attempts to enter Chinese Market

With LinkedIn making its entry into the Chinese market after many people were skeptical about the Western network getting over the countries great firewall, its greatest challenge lies in adapting to an entirely different culture. In comparison to the Western world, Chinese relationships are more private, and people keep their cards very close to their chest, which is the opposite of LinkedIn’s fundamental approach; publicly broadcasting one’s professional contacts.

Trying to change the mindset of an entire society will ultimately result in failure. LinkedIn is still in young in China, and is effectively seen as a startup but if it manages to adapt effectively and localize its use here, it may provide China’s young-up-and-comers with another professional social network in which to build relationships.

Source: Tech In Asia

Fri

11

Apr

2014

Daily Digital Pulse of China: WeChat, Cache-Cache & B2C

China Digital

WeChat adds image recognition feature which can benefit online-retailers

Since the release of the WeChat 5.0 version (launched in August last year) users could already learn more about a product like books or music albums by scanning the barcode on the cover or packaging and be redirected to the company website – and in some instances directly to the e-commerce sites for purchase.

This week WeChat released a new Image Recognition Feature. Now users no longer have to rely on barcodes but can simply scan a book cover and e.g. read reviews from Douban Book (a popular chinese platform for book ratings and reviews) or purchase the book directly from online retailer Dangdang.com. WeChat plans further enhancements to this service which is currently offered for free.

Source:Technode

Source:JingDaily

China E-Commerce

French Ready-To-Wear Brand Cache-Cache to accelerate it’s development in China E-Commerce.

As part of its development strategy in China, the French ready-to-wear brand Cache-Cache has decided to step on the accelerator for their investments in the Chinese e-commerce market. The brand has over 850 brick-and-mortar stores across the country and is already selling its products on Tmall. Cache-Cache is now considering to have its own platform of e-commerce to reclaim its online business in order to support its omni-channel strategy based on web-to-store. Online sales should allow the brand an annual growth of 30%.

Source: Les échos de la franchise

China E-Commerce

China’s B2C Industry Rapidly Gains Market Share

Despite both platform types growing at double-digit rates, it seems as though Chinese online consumers are increasingly turning towards business-to-consumer platforms over consumer-to-consumer ones to satisfy their online shopping desires. C2C platform sales accounted for nearly two-thirds of all Chinese online retail sales in 2013, but it has been predicted that the B2C sector would overtake the C2C one by 2017, as its growth rate is twice as fast. Why the rapid growth rate for B2C platforms? Shoppers have grown to prefer the higher quality and service of official flagship shops. It isn’t a matter of Taobao, China’s most popular C2C marketplace, performing poorly – it is simply due to the fact that there is more and more competition in an area where there wasn’t any for quite a while. The number of C2C e-tailers has actually decreased by 17.8% year on year from 2012 to 2013, and it is estimated to fall even further to just 9.18 million by the end of this year.

Source: iResearch China

Thu

10

Apr

2014

Daily Digital Pulse of China: Mobile Internet

China E-Commerce

China’s Mobile Internet Industry

China’s Internet industry has taken a turn to focusing on monetizing the smart phone market. Companies are gradually shifting their businesses from PC to mobile due to high mobile phone penetration rates in the country. Mobile phone penetration is nearly at 100%, and the majority of the aforementioned commoditization is coming from the increasingly popular, lower-cost, domestically produced smart phones, particularly within rural areas. Monetization for the industry is primarily coming from mobile gaming, e-commerce, and new forms of mobile payments.

At the end of 2013, Chinese mobile phone users exceeded one billion, with over half of them being smart phone users. It has been estimated that the smart phone penetration rate in China will reach or even exceed 90% by the end of this year. Despite this prediction, foreign smart phone shipments to China in the 4th quarter of 2013 decreased by 4.3%, quarter-on-quarter, the first drop since the 2nd quarter of 2011. This is mostly because of the attractive prices of domestic brand phones, such as Lenovo, Xiaomi, and Coolpad, (which typically go for less than half the price of an Apple iPhone). The average purchase price of a smart phone in China actually dropped from 2,321 RMB in 2011 to 1,773 RMB (US$286) in 2013.

The availability of these new, affordable smart phones allows for residents of rural areas to be able to access the Internet for the first time. It has been reported that 62% of mobile Internet users earn less than 4,000 RMB per month, with migrant workers making up a significant part of this total. The Chinese government, however, has plans to help rural areas catch up to the more affluent cities by aiming to achieve 85% fixed broadband penetration and 95% 3G/4G user penetration by 2020.

With smart phone penetration on the rise, mobile e-commerce is growing rapidly. Online transactions in China reached 1.9 billion RMB in 2013, making up 7.8% of total retail sales in the country. The mobile shopping industry’s total transaction value grew by 165% to 168 billion RMB, nabbing 9% of the total online shopping industry, as compared to just 4.8% in 2012. It has been estimated that it will eventually reached one trillion RMB by 2017.

Besides smart phone penetration getting so high, what else is contributing to the growing rates of mobile shopping? The big e-commerce platforms are heavily promoting mobile shopping by providing discounts to those making purchases via their mobile devices. Also, people are increasingly choosing to spend the little free time they have to shopping through their mobile devices instead of stepping foot in shopping malls.

Source: Fidelity

Wed

09

Apr

2014

Daily Digital Pulse of China: Jingdong

China E-Commerce

JD.com to Develop its O2O Model

Jingdong has signed with about 10,000 Chinese convenience stores to establish an innovative online-to-offline retail plan. These 10,000 convenience stores will cover 15 cities, and will include brands like Quik, Good Neighbors, Buddies, C&U, and Meijiya. The deals will let Chinese customers buy items online and have them delivered or be picked up at physical locations. It will also let them use online payment methods at the brick-and-mortar stores themselves.

Source: China Tech News

China E-Commerce

JD.com to take a Leap into the Chinese Virtual Communications Industry

JD.com will be launching JD Mobile this May, which will include both products and numbers. JD.com recently revealed the brand logo and a sample SIM card designed for the line. The new logo will have Joy, JD.com’s mascot dog on it, representing a link between the parent company and this new one.

Source: China Tech News

Mon

31

Mar

2014

Daily Digital Pulse of China: Alibaba's Investment & Tmall

China E-Commerce

Why Foreign Brands Use Tmall

When considering selling their products in China, foreign companies simply cannot ignore the influence and significance that Tmall has on the market. The site attracts hundreds of millions of Chinese shoppers, a fact that should not be overlooked. Asos, having officially entered China a few months ago with a bit of a thud, has realized this and will finally be opening its official Tmall flagship store in April, offering a 50% off cardigan sweater to attract customers. Tmall, with over 2,000 foreign brands and 70,000 sellers in total, dominates 45% of the B2C e-commerce sales in China. Alibaba’s impending IPO, which is slated to be one of the biggest public offerings in U.S. history, has the potential to increase the platform’s exposure and allow it to more easily attract foreign brands. With a growing Chinese middle class comes the desire for more foreign goods.

Source: Wall Street Journal

China E-Commerce

Alibaba Invests $692 million in Chinese department store chain

Alibaba has invested $692 million USD in InTime Retail, which has 28 department stores and eight shopping malls across the nation. The deal will let Alipay users pay in-store using their mobile apps after syncing the app to virtual prepaid cards. Online changes will also occur. Tmall shoppers will be able to earn InTime member points at select stores, and InTime will ship merchandise to online buyers from their physical stores. Doing this will shorten delivery times in some areas, and will also widen the range of international fashion brands offered to Tmall customers.

Source: Tech In Asia

Thu

27

Mar

2014

Daily Digital Pulse of China: Tencent, E-Payments, Alibaba & Jingdong

China E-Commerce

Tencent Invests in South Korean Mobile Game Company

Tencent has invested $500 million USD for a stake in South Korea’s CJ Games. CJ games develops both casual and more in-depth mobile RPG games. The casual ones are meant to be integrated with Korea’s KakaoTalk and its social gaming functions. When the deal is finalized, Tencent will own 28% of CJ Games. Not only does Tencent have the country’s most popular messaging app, WeChat, is is also China’s biggest gaming company. The deal could bring some of Korea’s games to China via WeChat.

Source: Tech In Asia

China E-Commerce

The Growth of China’s Electronic Payments is Going Strong

The vice president of Baidu has announced that Baidu will be establishing its own mobile game division by merging its Duokoo mobile game business with its 91 Wireless game business.

Source: Digital Journal

China E-Commerce

Taobao’s Foray into the Domestic Service Market

Taobao’s mobile app has launched a domestic services platform that connects customers with domestic service providers. This new feature is called “home life” and will initially only cover Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou, and 15 other cities. There are 70,000 regular housekeeping staff assigned to the platform. The service will be funded by Alipay and will allow patrons to rate the services afterwards.

Source: Women of China

Tue

25

Mar

2014

Daily Digital Pulse of China: Searched Content,

China E-Commerce

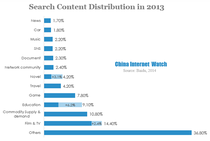

What Content Did Chinese Search Most In 2013?

A new report released by Baidu shows that in 2013, the top 5 most-searched contents were film&TV, commodity supply & demand, education, game and travel. The demand for education, travel, film & TV increased significantly in 2013. Baidu suggested webmasters paid attention to these field.When it comes to education webmasters may integrate information about professional examinations to provide one-stop service for users. In terms of course ware and recommendation, websites could segment users according to their vocation and demand, then provide them with specific information.Regarding the demand for travel, there are noteworthy differences for webmasters.The film &TV resources can be deeply integrated by relationship between films and actors. The content construction of information about film & TV is also important for webmasters.

Source: China Internet Watch

China E-Commerce

Alibaba’s Introduction of the ‘Cloud App’

Alibaba shifted up a gear against Amazon this week, with founder Jack Ma announcing the ‘Cloud App’ – a cloud service targeting the mobile user. Alibaba has moved quickly in this sector: February 24th 2014 saw an alliance between Alibaba and Neusoft (China’s biggest multinational IT service provider) to develop this cloud service. Amazon’s web service ‘AWS’ was launched in 2006 and has grown to be the global leader in cloud computing. Their dominance globally has led Amazon to entering their 10th market with confidence, and December 18th 2013 saw this entrance into the Chinese market, leading to both Ali Cloud and Tencent Cloud giving 40% to 50% discounts on their service. Although AWS is seen as invincible in the global market, the Chinese market may be a harder nut to crack - Alibaba will not give up without a fight.

Source: China Internet Watch

Mon

24

Mar

2014

Daily Digital Pulse of China: Tencent, WeChat, Alibaba

China E-Commerce

Tencent Invests in Mobile E-Commerce Site for Low-Income Phone Users

Maimaibao, a mobile commerce retailer that caters specifically to low-income mobile phone users, has received an undisclosed amount of funding led by Tencent. How does Maimaibao specifically target such users? It does so through implementation of a WAP mobile website, which is accessible from Symbian and feature phones on 2G networks. A majority of Chinese people who use such phones generally live and work in places that don’t offer access to PCs and are people who cannot afford to buy more advanced smartphones. What is WAP? It is a simplified protocol that was used on some phones before HTML was supported, and is still occasionally used for simple tasks such as email, reading news, downloading music, and checking stock prices. Not many websites actually support WAP these days, however. Maimaibao was one of the pioneering Chinese companies to enter the mobile commerce industry, and its focus is still on WAP. This new round of funding will be used to create a new budget smartphone under the brand Big Q, which already has three available models, all of which drive traffic to Maimaibao’s store. Maimaibo sold 200,000 of the phones last year, and is working towards selling a million this year. Maimaibao also saw a turnover of 2 billion RMB last year, and reported and average order of 300 RMB.

Source: Tech In Asia

China E-Commerce

WeChat Reaches 355 million Monthly Active Users in Q4 2013

WeChat’s monthly active user numbers have soared to 355 million, a 121% year-over-year increase and 6% quarter-over-quarter. Typically, most other mobile services count simply logging in as an active action, whereas Tencent only counts either sending one message or making a transaction as one.

Source: Tech Node

Thu

13

Mar

2014

Daily Digital Pulse of China: Online Food Ordering & Smart Devices

China E-Commerce

Ordering Food is China’s Most Popular Offline-to-Online Activity

Many restaurants have been taking advantage of the Internet by allowing customers to order their food online via computers and smartphones. Various online food ordering services used different marketing initiatives, such as giving subsidies to restaurants and catering companies and announcing special offers and giveaways to customers. Yi Tao Shi, one of the major online food ordering companies, has 300 food delivery employees all around the country. The even bigger E Le Ma has established 12 branches throughout the nation. So how do these companies make profits? Typically from charging advertising fees from restaurants and commission fees from restaurant orders and fees collected from food delivery.

Source: Want China Times

China E-Commerce

China’s 700 Million Smart Devices

China’s population collectively owns 700 million smart devices, only 59% of which were bought to replace a consumers’ previous smart phone or tablet. This means that nearly have of the country’s smart devices were first-time purchases. We can see that more and more Chinese citizens are moving toward the use of smart devices. Devices priced above $500 USD make up 27% of the total, and users of these higher-end devices have a more diverse range of needs, whereas those who use devices that are $150 or less tend to use their devices for games more so than anything else. The top 10 most popular Android devices are completely comprised of Samsung and Xiaomi products. While 4G is still growing, it has been predicted that the service won’t truly take off until next year. The path to success for all such devices, however, seems to be socialization of apps. 55% of Chinese market apps provide links to Chinese social networking services and the volume of app content sharing to social network platforms per mobile Internet user per day has tripled in the past 6 months.

Source: Tech In Asia

Wed

12

Mar

2014

Daily Digital Pulse of China: E-Commerce, Alibaba & Tencent

China E-Commerce

Asia’s Half-Trillion Dollar E-Commerce Market

Go Globe’s new infographic on e-commerce in Asia is stunning in two ways. Visually, it’s very appealing. What’s more, the information it contains is pretty mind-blowing as well. Some highlights on the Chinese side of things are as follows.

- China’s e-commerce spending is double that of Japan. It is projected that Chinese online shoppers will spend $274.5 billion in 2014, as compared to just $127 billion in Japan.

- 60% of online spending in Asia is done by Chinese consumers.

- 74% of Chinese mobile phone users utilize their devices for product price comparisons and reviews, as compared to just 43% for the global average.

Source: Go Globe

China E-Commerce

Alibaba Aqcuires a Majority Stake in ChinaVision Media for $804 Million

Alibaba has acquired 60% of ChinaVision Media, a company that provides a myriad of media-related services, such as newspapers, movies, mobile content, television program promotions, artist management, and more. The company directly invests in movies as well as licensing content from third-party content providers. Alibaba has been developing Aliyun OS, which is an Android-based operating system for smartphones and smart TVs. The OS on its own doesn’t seem to be enough to attract users, however, so investing in the content that ChinaVision owns might make it so.

Source: Tech Node

Mon

10

Mar

2014

Daily Digital Pulse of China: Tmall, WeChat, Dang Dang, Yihaodian, Jingdong

China Digital

Promotion for U.S. Pork Goes Live on Tmall

A flagship store has opened on Tmall this week, one that guarantees delivery of eight U.S. pork items within 24-48 hours. The site is also offering discounts of up to 50% off during a seven-day sale celebrating its grand opening. The new site brought in more than 400,000 visitors within the first few hours of business. There was even a draw organized by the USMEF giving away a sample of American pork, which received 2,000 applications in the first hour. The pork products are sourced from three U.S. processors and are sold through three specialized distributors who deliver the frozen products in under 48 hours. The site is providing a wealth of information on U.S. pork products, including an informational video on the production of pork in the U.S. The distributors are also promising product quality buy providing a ten-fold money back guarantee. The USMEF has been working for a year to build up its online sales potential. Initial efforts were focused on assisting online vendors with ideas and expertise in order to better packaging so the geographical footprint of shipments could grow.

Source: KTIC Radio/a>

China Digital

WeChat in Midst of Testing POS Payment

It has been claimed that WeChat will launch its POS payment system on March 22 o fthis year. Its POS system will consist of customized POS machine and WeChat payment, targeting offline store payment. When a customer is purchasing goods, the special WeChat POS machine will generate a QR code to be scanned and paid with WeChat payment. This move is yet another push for WeChat’s offline to online integration plans and to enter the retail payment market.

Source: China Internet Watch

China Digital

Dangdang and Yihaodian Partner Up

Dangdang, China’s largest online book retailer, and Yihaodian, one of China’s major online supermarkets, have teamed up and will launch flagship channels on each other’s platforms. Both of the stores will offer the same products, pricing, logistics, and customer service that are already available on each respective website. Knowing all this, why the partnership, then? The companies can then enrich the product selections available to their customers.

Source: Want China Times

Wed

05

Mar

2014

Daily Digital Pulse of China: Tencent, Mobile Messaging Apps, Online Video Sites

China Digital

Tencent Opens Its Payment Service to All Businesses

Tencent has done something big for its popular mobile messaging app, WeChat. It has added support for any brand to allow their consumers to make purchases or buy services within the app itself. It also works for in-store payments. With the app’s ubiquitous nature, this feature is sure to bring more brands to WeChat and more users to its payment feature.

Source:Tech In Asia

China Digital

Analyzing China’s Top Mobile Messenger Apps

Tencent’s WeChat and QQ have all the other competitors beat by quite a bit, with QQ’s 325.71 million active users and WeChat’s 295.712 million. Another point to note is that male usage outnumbers female usage by quite a bit, as males make up 61.69% of the demographic and females make up the rest. Users of such apps are predominantly in the 35 or below age group and from medium and low income backgrounds. When considering occupation, workers/service workers were the primary group, followed by public institution leaders and staff, and after that, students.

Source:China Internet Watch

China Digital

An Overview of China’s Online Video Market during Q4 2013

China’s online video market reached 12.81 billion RMB, with a 41.9% year-on-year increase. That market is expected to maintain rapid growth and reach 36.6 billion RMB by 2017. What’s contributing significantly to these revenues is the fact that mobile client commercialization is increasing, and thus, bringing copyrighted content (television shows and sporting events) to such online video sites. Revenues from advertising accounted for 75% percent of total revenue in 2013. This percentage is expected to increase to about 77.1% in 2017. The monthly online video user coverage of PC web pages and PC clients was 460 million and 340 million respectively in November of 2013. The user scale continues to grow remain at a stable, steady rate. In contrast, the number of users of mobile video apps reached 170 million in November of 2013, up a staggering 72.9% compared to the number of users in December 2012.

Source:China Internet Watch

Mon

03

Mar

2014

Daily Digital Pulse of China: Alipay, Alibaba & Luxury E-Commerce

China Digital

Alipay Discontinues WeChat’s API Payment Gateway

Not long ago, Alipay announced that it would shut down the application programming interface (API) payment gateway for Tencent’s WeChat public accounts platform, which would cause a bit of grief to WeChat in the short term, as it is still trying to establish its merchant groups. This isn’t the first time something like this has happened in the Chinese e-commerce world, however. In 2004, eBay tried to block Alibaba’s Taobao, but Taobao offered free listings to sellers and introduced website features created in the best interests of local consumers. Also, in 2008, Taobao blocked the search service of Baidu. This type of ‘blocking’ has become the norm in China’s internet industry and has resulted in fragmented user experience for Chinese consumers.

Source:Want China TImes

China Digital

Alibaba Teams Up with Retail Chain to Obtain Edge in O2O Market

Alibaba recently announced a joint campaign between Taobao’s mobile operations and five retail chain operators for the upcoming March 8th shopping festival. A trial service will be introduced at one Intime City mall in Hangzhou, allowing users to pay for their purchases by mobile phones rather than at the till. An Intime executive has said that e-commerce must be embraced by retailers. The partnership will let consumers consumers can connect online shopping options and those in the real world so that they can also make purchases at brick-and-mortar stores. Alibaba also plans to work with operators in marketing, traffic, member database, and payment services. Alipay will also offer discounts and bargains to users of its e-wallet mobile payment services at stores of seven convenience store chains.

Source:Want China Times

China Digital

Alipay Now the Largest Mobile Payments Platform in the World

The number of Alipay users reached 300 million at the end of 2013 and have made 12.5 billion payments via the service. Over 2.78 billion of these payments were made through Alipay’s mobile service, totaling 900 billion RMB ($150 billion USD). Total mobile payments through Square and Paypal equaled to about ($50 billion USD).

Source:China Internet Watch

Fri

28

Feb

2014

Daily Digital Pulse of China: Ctrip, WeChat, Jingdong, Social Media, Alibaba & Mobile Shopping

China Digital

Ctrip to Implement WeChat Payment Service for Purchasing Attraction Tickets

Users of this service will soon be able to buy train tickets, group-buy deals, gifts cards, and more. Unlike purchases for flight tickets, hotels, and other similar travel-related necessities, attraction tickets are more likely to purchased via mobile devices as they require smaller amounts of money and are usually needed during the actual time of travel. Purchases made through this WeChat payment system will be eligible for discounts of 20%-30%, while ordering through the proprietary Ctrip mobile app will allow users to receive a 5 RMB cash reward.

Source:Huaxia

China Digital

Tencent Likely to Buy Stake in Jingdong

Tencent has reportedly hired Barclays to advise on the matter of acquiring a part of JD.com, China’s second largest B2C e-commerce marketplace. This move will afford Tencent more leverage in competing in its multi-faceted rivalry with Alibaba, China’s other Internet giant.

Source:eBrun

China Digital

China’s Social Media Landscape for 2014

For every Western social site or app, there seems to be a Chinese counterpart. Typically, these Chinese-developed sites are in response to things blocked by the Great Firewall. In any case, the Chinese social media scene is a much different animal to that of the West, and the accompanying infographic may help to demystify things just a bit. Some highlights of the graphic are as follows:

- WhatsApp is not often used in China. Its counterpart, WeChat, is the main messaging app used by what feels like the entire Chinese population.

- Youtube is blocked, but there is a wide array of video services to choose from, the most popular ones being Youku and Sohu. These sites often contain licensed telvision shows and movies.

- Even when the Great Firewall isn’t in the way, Chinese apps still seem to be more popular, as is the case with WhatsApp, Instagram, and Vine.

Source:Tech In Asia

Thu

27

Feb

2014

Daily Digital Pulse of China: Baidu, Jingdong, Mobile Penetration, LinkedIn & Mobile Games

China Digital

Baidu Continues to Obtain More Acquisitions in 2014

Despite a 50.3% rise in revenues year-on-year, net profits for Baidu dropped 0.4% during the last quarter. Most of this dip can be attributed to a veritable acquisition sprees that the other two Chinese Internet giants (Alibaba and Tencent) went on last year. In the past year, Baidu bought 91 Wireless, an Android app store, Nuomi, a group-buy site, a video portal, and Zongheng, and e-bookstore. 20% of Baidu’s total revenues, however, came from mobile, as it runs the fourth most popular android app store in China.

Source: Tech In Asia

China Digital

Jingdong Interested in the Virtual Credit Card Market

As we mentioned previously, JD.com has established its own virtual credit line for its customers, with much cheaper rates than traditional banks. How can the platform be able to charge so much less? It can do so because of the enormous amounts of shopping records that it has collected over time. For example, if a customer regularly buys maternity and baby products, that customer is more likely to have a family and stable income, thus resulting in personal credit. The question that now arises is: Will Jingdong’s credit service be able to replace some small credit cards? Some finance experts seem to think that it is indeed possible. However, what might be the biggest obstacle in JD’s way is the other Internet giants who are also trying to become major financial players.

Source: iResearch China

China Digital

LinkedIn has Launched the Chinese Localized Version of Its Site

LinkedIn launched the beta version of its site on February 25th, naming it “Ling Ying.” Learning from the previous in-China failures of other Internet giants like Google and Ebay, LinkedIn built an entirely new model to take on the Chinese demographic. LinkedIn actually established a joint venture in China with Sequoia China and China Broadband Capital instead of simply setting up a branch company in the country. With the help of local companies, LinkedIn China could more easily operate in a Chinese manner.

Source: China Internet Watch

Thu

20

Feb

2014

Daily Digital Pulse of China: WeChat, Money Rewards & Weibo Record

China E-Commerce

Record: Over 800K Weibo posts first minute of year of the horse

More than 34 million Weibo users interacted during the Spring Festival Gala and posts referring to the festival reached 45.41 million in a little more than four hours. It was, however, in the first minute of the New Year of the horse that the new record was set. 863 408 posts were published – compared to the previous year, when 808 298 posts reached the Weibo web. The first day of this year’s Chinese Spring Festival took place on the 31st of January.

Source: Xinua Net

China E-Commerce

Taobao will reward users who discover "hacker loopholes" with 50K RMB

A loophole that could be used to hack accounts was discovered on E-commerce site Taobao. Through the loophole hackers would be able to gain access of all sorts of information including account balances, transaction records, shipping addresses and other sensitive private details. The vulnerability has supposedly been fixed, but users still worry that the privacy hazard will trigger a new wave of security threats. Taobao officials insist on having eliminated eventual risks and promise to honor alarming users who notifies the company about any future breaches with 50 000 yuan straight from the company’s reward fund.

Source: News 163

China E-Commerce

Tencent takes 20% stakes of daily deals-app Dianping

Tencent has announced that they are going to take a 20 percent stake in Dianping, the Chinese listings portal that also offer daily deals. This partnership will invite a lot of Dianping content (consumer reviews, online restaurant reservations and take-out ordering services) to Tencent’s two giant social networks; WeChat and QQ. WeChat is already covering mobile payments, taxi- and cinema bookings – which will make it an even stronger E-commerce platform. Alibaba might have to step it up if they want Alipay to remain China’s top e-wallet service.

Source: Finance iFeng

Wed

19

Feb

2014

Daily Digital Pulse of China: E-Payment, Digital Advertising, International Retailers & WeChat

China E-Commerce

E-payment business grows rapidly 2013

With 25.78 billion online orders and a turnover of 1.075 trillion yuan, Chinese E-payment business went up 27,40% compared to the previous year, according to data released by People’s Bank of China. E-payment includes three categories of payment services – online payment, mobile payment and phone payment. The turnover of the complete Chinese mobile payment industry rocketed to 9,64 trillion yuan ($1.59 trillion), meaning a growth of 317%.

Source: Tech Node

China E-Commerce

8 Facts about digital advertising in China

- Online shopping is one of China’s highest growth categories. In 2011 it had a growth of 30%, compared to 50% last year.

- 70% of China’s more than half a billion internet users are first-time users surfing the Web on a mobile device.

- The Chinese digital market will be larger than its TV market this year.

- The money spent on social media ads will grow faster than any other of the digital sub-segments. The compound annual growth rate (CAGR) will be up 67,6% by 2018.

- Mobile social will make up more than 10% of the Chinese digital market 2018.

- The growth of mobile usage leads to larger digital ad revenues. Chinese mobile-based advertising comprises 10% of digital ad revenues and 3.5% of the total ad revenues.

- After the U.S., China has the largest search advertising market in the world. Top five advertisers in China 2013 are P&G, China Mobile, Volkswagen, L’Oreal, & 360Buy.

- The most popular online activity is instant messaging (85%)

Source: Clickz

China E-Commerce

International retailers struggle online

Fast-fashion retailers expanded at a faster rate than luxury retailers in China last year. Companies like Zara, H&M and C&A opened more stores than planned, while 65 percent of the luxury retailers did not reach the expansion goal. However, international retailers are not doing a great job online, where domestic operators are dominating. The international retailers struggle with the Chinese online shopping for various reasons. According to a survey, made by KnightFrank, a few of the factors include difficulties of finding good quality sites, new policies on anti-corruption or a change in strategy for internal reasons. Domestic online operators account for circa 50 percent of the internet commerce, while international retailers represent less than 3 percent of the online market share. to know their customers long after they leave their stores.

Source: Retail In Asia

Mon

17

Feb

2014

Daily Digital Pulse of China: Tencent, Dianping, WeChat, Luxury Consumers, & Mobile Browsing

China E-Commerce

Tencent Takes a Stake in Dianping

Recent rumors of Tencent’s possible acquisition or investment in Dianping have become fact. Multiple sources have revealed that Tencent has already acquired a stake in Dianping and will announce the news early this week.

Rumors are circulating that a 20%-25% stake has been bought by e-commerce giant Tencent - valued at around USD1.8 – 2 billion.

Dianping is currently in its eleventh year, being founded in April 2003 and is currently the most popular ratings & review service in China. As of Q4 2013, active monthly users were at the level of 90 million, 75% of views coming from mobiles. The platform currently has 8 million merchants and 30 million ratings/reviews – covering 2,300 cities in China and a dozen countries.

Dianping has found its competitors in group-buying and other lifestyle/local sectors. Since group buying has become one of Dianping’s major revenue sources, group-buying services such as Meituan have become direct competitors.

Having had a slower growth rate than some other group-buying services, Dianping has big plans for acceleration this year – the company has now launched a food delivery service and is currently building a hotel booking service.

It is expected that Dianping’s services will be integrated into Tencent’s properties, especially their successful mobile messaging app WeChat.

Source: Tech Node

China E-Commerce

Who is the Chinese Luxury Consumer?

Pinning down the quintessential Chinese luxury consumer is a tough thing to do, as there are a few different types. It has been estimated that globally, there are 300 million luxury consumers who spent $295 billion USD in 2013. In terms of size, the Chinese made up the third largest group (14% of the total), after Americans and Europeans. Spending-wise, however, the Chinese were second in line with $1.7 billion USD, right after the Middle Eastern consumers. Breaking down the global luxury consumers, we can estimate that about half, or 150 million of them, are true luxury consumers, or people who purchase luxury goods on a consistent basis. Though they only make up half the group, they account for about 90% of 2013’s total luxury market, and the Chinese make up about 19% of this group ($29 million USD). Today we’ll be looking at the two groups, omnivores and the opinionated, of Chinese luxury consumers who make up 60% of the group as a whole. Overall, females are the top spenders (60% of the group) and Chinese luxury consumers will spend mainly overseas and at monobrand stores. Another factor that contributes to luxury spending is gifting, which is seen as a cultural ritual.

Omnivores: Omnivores are known as those new to luxury and are often inhabitants of lower-tiered cities. They have an insatiable appetite for luxury and are brand name and status conscious. This group is the one typically portrayed in the media. Omnivores do most of their shopping abroad and have low sensitivity to advertising and are influenced by social networks. They are usually in the 30-40 age group (the lowest age group of the consumers).

The opinionated: The members of this group are typically found in Beijing and Shanghai, followed by Western Europe and the U.S. This consumer is typically a highly educated manager in his/her early 40s. They shop repeatedly throughout the season, usually in his/her hometown or country, during work-days. They leverage new technologies and tablets. They are strong luxury connoisseurs with the highest level of brand awareness. They are very receptive to superior in-store service, and targeted communication is crucial to driving their purchases.

Source: Red Luxury

China E-Commerce

The Chinese are Spending Twice as Much Time on Mobile Browsers as They Did Last Year

UC Browser is the most popular mobile browser in China, with 65% market share when measured in monthly active users. The effective usage time on mobile browsers increased by 97% from November 2012 to November 2013. These browsers also reached 210 million monthly active users by November 2013, a 51 percent increase from the year prior.

Source: Tech In Asia

Tue

11

Feb

2014

Daily Digital Pulse of China: Baidu & Alipay

China Digital

Baidu Users Comparing Luxury Goods Prices

It’s no secret among China’s luxury consumers that the prices of luxury goods are much higher on the mainland than elsewhere, but they’re getting more cost-savvy—new data from Baidu shows that internet users consider price to be the most important concern when searching for luxury goods online. Baidu’s data centre reports that the term “price” was by far the most common search term associated with luxury bags and watches in 2013. Internet searches are often used to find the original price of luxury goods before China’s notoriously high tariffs are imposed, says the report. Chinese luxury consumers are using price searches to measure whether or not items are worth buying. The high prices have driven Chinese consumers to buy an estimated two-thirds of luxury goods outside the mainland. In addition, they use a variety of other purchase methods to avoid tariffs, such as daigou (buying online from someone who has purchased an item abroad) or having their travelling friends and family buy items for them.

Source: Jing Daily

China Digital

Alipay Is Worlds Largest Mobile Payment Provider

Alipay, the payment subsidiary of China's largest e-commerce firm Alibaba Group, said over the weekend that its total mobile payment volume reached 900 billion yuan ($148.41 billion) in 2013, making it the largest mobile payment provider in the world. The number has far exceeded the combined payment volume of the world's two leading payment firms, US-based Square Inc and PayPal, a division of eBay Inc, the company said in a posting on its official Sina Weibo account Saturday. But Alipay is facing increasing competition. Major rival Tencent launched its mobile payment service via its popular instant messaging service WeChat in August 2013, which many analysts consider a strong competitor for Alipay in the mobile payment field. WeChat payment has gained a significant number of users through its aggressive promotion recently, such as its cooperation with taxi-hailing app Didi Dache and its "red envelope" campaign during the Spring Festival holidays, which enables users to send out cash gifts to their WeChat friends by linking their bank cards to the software. Feeling the competition, Alipay also launched a similar cooperation with taxi-hailing app Kuaidi Dache, hoping to cultivate users' habit to use mobile payment services in offline deals.

Source: Global Times

Thu

06

Feb

2014

Daily Digital Pulse of China: Mobile Commerce & New Year

China E-Commerce

China Consumers Favor Mobile Commerce

Mobile payment services in China saw strong growth in 2013. A new report from iResearch, an online tracking and data analysis firm, shows that independent mobile commerce platforms have found a great deal of support from Chinese consumers. People throughout the country are turning to these platforms in order to shop online and pay for products with their mobile device rather than with physical currency. As device ownership continues to grow, mobile commerce is expected to become much more prevalent throughout the country. Chinese consumers favour mobile commerce services because of their convenience and the fact that they allow people to manage their finances from their mobile devices rather than being forced to do so at home from their computers. The iResearch report also suggests that mobile shopping is no longer the main attractor of most mobile commerce platforms. According to the report, online money transfers and banking features are quickly becoming the main reason people use these platforms. As these services see more attention from consumers, their use of NFC technology is beginning to diminish. China has established itself as a very active and attractive mobile market. Not only are mobile payments flourishing throughout the country, but mobile games are also generating a great deal of profit and economic activity. Advertisers in China are also beginning to focus on mobile consumers more aggressively, launching interactive mobile marketing campaigns that are designed to be more dynamic than traditional marketing initiatives.

Source: Mobile Commerce Press

China E-Commerce

Chinese New Year Market Snapshot

China's consumer market boomed during the first few days of the Lunar New Year holiday despite falling luxury gift sales, according to the country's Ministry of Commerce on Wednesday. In the first four days of the week-long Spring Festival holiday, the most important traditional holiday in China, consumer market sales expanded steadily and quickly, the ministry said in a statement on its website. Without giving nationwide figures, the ministry said consumer market sales in the cities of Beijing and Chengdu had risen by 9.2% and 13% year on year respectively. According to the ministry, sales in Shaanxi, Anhui and Henan provinces grew by 14.3%, 11.2% and 10.4% respectively. Online business and the catering, tourism and entertainment sectors have also prospered during the holiday, according to the ministry. Sales of luxury gifts such as expensive alcoholic beverages and rare seafood, which are sometimes sent as gifts to officials during the holiday, have fallen sharply. Experts have viewed the drop as a direct result of the central government's anti-graft and frugality campaign.

Source: Want China Times

Wed

05

Feb

2014

Daily Digital Pulse of China: LinkedIn & Tesla

China Digital

LinkedIn Targets Growth in China

The one major U.S. social network not blocked in China is starting to expand its presence in the world's most populous nation. LinkedIn, unlike Facebook, Twitter and Google, is not banned by state censors, but only recently appointed its first president for China, George Shen. Shortly thereafter, LinkedIn started to integrate its accounts with users' profiles on the Chinese chat app WeChat, which has around 300 million monthly users. Internet analysts and recruiters say that LinkedIn has a better chance of catching on in China than many other US tech groups. Other groups, if they were unblocked, would need to compete directly with China's established tech giants. Tencent, whose HK$991.6 billion (US$127.7 billion) market cap is less than $5 billion behind Facebook's, runs WeChat, which is increasingly popular as a social network and marketing platform. Sina dominates blogging with its Twitter-like Weibo microblog, which is partially backed by ecommerce giant Alibaba. Baidu and Youku Tudou, meanwhile, lead in search and online video. The online job hunting market, however, is fragmented between local groups such as Zhaopin and 51job, and a very high turnover rate among employees means high demand for recruiting services. Despite not offering a complete Chinese version of its desktop site, LinkedIn says it has more than 4 million users in China. Globally, it has 260 million members, 54 million of whom are in Asia.

Source: CNBC

China Digital

Carmaker Tesla Wins China Fans With 'Fair' Price Strategy

In China, where higher prices mean prestige, luxury U.S. electric carmaker Tesla is taking a bold step to win over clients by curbing the mark up to just half of what some of its rivals can command. Though it risks relegating its brand to a lower tier, Tesla's marketing strategy could prove a model for other imported brands, which have come under fire from China state media and regulators for inflated prices. In a blog post last month, the firm detailed the lower-than-expected 734,000 yuan ($121,400) China price tag for its high-end Model S electric car. The price, still 50 percent higher than in the United States, includes only "unavoidable" taxes and transport costs. One reader survey on popular site QQ.com, which received over 80,000 votes, showed that 90 percent of consumers supported the U.S. carmaker's move. Analysts said the lower price strategy could deter premium segment buyers, who are usually willing to spend extra to guarantee quality. While other auto firms already offer price rebates to lure China buyers, Tesla is the first to make a clear statement about charging Chinese shoppers the same as in overseas markets, turning transparency into a neat marketing ploy. Last year, Tesla's total car sales were around 22,500, mostly in the United States. The California-based company, which plans to open stores in 10 to 12 Chinese cities by the end of 2014, says it expects China to contribute to one-third of its sales growth this year.

Source: Reuters

Wed

05

Feb

2014

Daily Digital Pulse of China: Foxconn & WeChat E-Trading

China E-Commerce

Foxconn to launch B2B e-trading platform

Hon Hai Precision Industry — the world's largest contract electronics maker, also known as Foxconn — will launch a business to business (B2B) trading platform in early March, a move perceived as a way for the company to broaden its business model. As the first step for the new initiative, the company will develop a B2B e-trading business by launching a platform called B2BFoxconn.com, which will become a venue for selling semi-finished electronics products in the initial stage. Hon Hai has ambitions to transform itself into a commerce-oriented company from a manufacturing heavyweight by selling its products by itself, and that the B2B platform is expected to help the manufacturer reach this goal. Hon Hai will develop its commerce operations in a bid to provide value-added services to its clients.To facilitate the e-commerce development, the new business will be supervised directly by Hon Hai's headquarters, while the company will coordinate its subsidiaries in a bid to develop their e-commerce platforms.

Source: Want China Times

China E-Commerce

WeChat Used For Art Sales In China

The use of Chinese instant messaging app WeChat as a sales channel for collectors has added an unintended feature to the popular smartphone application. The number of deals struck over mobile phones for art works and artifacts are on the rise in China, and WeChat's "friend circles" feature has made the app the most favoured option among collectors. Antique shops have also joined the bandwagon, with one vendor of Song dynasty (960-1279 CE) ceramics in central China's Henan province saying that his sales through WeChat have grown five folds compared to sales through his physical store. The shop owner said that WeChat offers an atmosphere of sharing a hobby among collectors similar to that in the real world since they can comment on the photo of an item and chat with others through texts, voice messages or video calls. Meanwhile, art expert Zhou Zhiyao said that WeChat has helped antique shops, dealers and collectors to share information in a more efficient way and garner popularity. There have been some collectors who conducted auctions through WeChat on a small scale, Zhou said, adding there is a potential for such a format to play a supplementary role for traditional auctions in the future.

Source: China's Future

Mon

03

Feb

2014

Daily Digital Pulse of China: WeChat Banking & Bitcoin

China Digital

WeChat Banking Emerges in China

Several Chinese banks have now launched banking services via popular mobile phone app WeChat, as they try to tap into the rapidly changing online business world. Launched as an instant messaging smartphone app, Tencent's WeChat began attracting banks, which have established accounts dedicated to businesses and groups, after introducing payment features. Two of the services commonly offered through these banks' WeChat accounts, are a search for branch locations and the ability to make appointments to avoid queues at the bank. China Everbright Bank's WeChat service can even recognise a user's location and send locations of nearby branches to the user's phone. WeChat also provides an alternative to the banks' service hotlines, with some of the banks hiring staff to man the service. Besides checking their account balance, China Merchant Bank, China Everbright Bank and Shanghai Pudong Development Bank allow their clients who have signed an additional contract to buy financial products through their WeChat accounts. For people who are not familiar with using apps or even smartphones, these WeChat banking services are just a novelty among the youth but as the e-commerce and online banking sectors continue to grow it is likely the adoption of these digital services will spread.

Source: Want China Times

China Digital

BTC China Starts Accepting Deposits Again

In December 2013 BTC China, the online currency exchange, stopped accepting deposits in its home currency, RMB. Since then, what was once the world’s largest Bitcoin exchange by transaction volume has continued to exist using a voucher system. But on Friday, after a six-week hiatus, BTC China started accepting deposits in RMB again. BTC China now offers a bank transfer payment method, but the third-party systems – Alipay, Tenpay, Yeepay, etc – are yet to move into the market. The news might not bring forth a resurgence of Bitcoin fever like we saw late last year, though. Many Bitcoin enthusiasts cashed out when the Bank of China made its announcement in December. To help regain some of its former glory, BTC China has launched a program where those who post multiple buy and sell offers receive a bonus fee, and those who take the offers are charged a fee. The aim is to increase liquidity in the market Until February 15, every time RMB 100,000 ($16,500) is rebated through the program, the maker and taker whose transaction passes the 100,000 threshhold each receive an RMB 1,000 ($165) prize. Many of BTC China’s domestic competitors, such as OkCoin and Huobi, do not charge a commission and have been using the bank transfer method for some time. This digital market moves fast and it is expected that more developments will follow shortly.

Source: Tech in Asia

Wed

29

Jan

2014

Daily Digital Pulse of China: Internet Speed & Mobile Payments

China Digital

China’s Mobile Payments 707% Growth in 2013

The total transaction volume by Chinese independent mobile payments services reached 1219.74 billion yuan (roughly $200bn) in 2013, a 707% year on year increase, according to the latest report by online tracking and data analysis service iResearch. The independent payments that iResearch refers to are all payments services excluding those by conventional banks and China UnionPay, the bankcard association. And ‘payments’ include peer-to-peer money transfers. The major driver of the growth, however, isn’t mobile shopping anymore but online money transfer, credit card payoff and other mobile payment applications. Payments as a percentage through text messages decreased steeply in the past three years, from 92.5% in 2010 to 6.1% in 2013. 93.1% payments were through mobile payments apps or other services in this year. The share of near field payments declined from 2.6% one year ago to 0.8% — NFC, the only mainstream near field technology, isn’t widely adopted in China. But it is expected that other near field payment solutions like Alipay On-site, with QRcode and acoustic payment capability, will drive near field payments in 2014.

Source: Tech Node

China Digital

Internet Speed in China Climbs 14% in 2013

China’s average peak Internet speed reached 737.4KB/S in 2013, up 14% as compared with the beginning of the same year, according to a broadband speed overview released by Xunlei. The peak internet speed for Hong Kong, Macau and Taiwan is still higher when compared with that for other regions in Chinese mainland. The connection speed of Shanghai and Beijing reached 1,190.3KB/s and 970.2KB/s, respectively. The development of broadband infrastructure is quite uneven, while peak Internet speed of Xining, a city in North West China, is half that of Shanghai. From regional perspective, there’s little difference between the Internet speed of the North and the South. However, the Internet speed for eastern, middle and western regions shows a descending trend. This trend is highly correlated with the economic development levels of these three areas. Big data download capacity is becoming the rigid demand of users. China’s average download per capital per time reached 113MB, with 16 provincial-level regions exceeded 100MB and five areas surpassed 200 MB. In order to accelerate broadband construction in China, the central government released the “Broadband China” strategic plan last August, targeting full broadband network coverage by 2020. China is also planning to construct seven backbone network nodes in addition to three existing ones in Beijing, Shanghai and Guangzhou.

Source: Tech Node

Wed

29

Jan

2014

Daily Digital Pulse of China: Alibaba Diversification & Performance

China E-Commerce

Alibaba Backs China Potential For Vintage Luxury E-commerce

Now that Chinese e-tail giant Alibaba dominates China’s e-commerce mass market with behemoths Taobao and Tmall, it’s moving into something slightly more niche: vintage luxury. According to tech site Recode, the internet giant approached 1stdibs, a U.S.-based site which sells vintage luxury items through a network of retailers, to offer Series C funding. The luxury e-tailer was founded in 2001 with the goal of bringing the Paris flea market to the internet, which is certainly a high-end one—the average purchase price is $2,000, according to 1stdibs. The website offers a plethora of vintage fashion, jewelry, watches, furniture, and even fine art. Although based in the United States, Chinese buyers are part of the website’s significant contingent of international customers, which make up one third of its total buyers. Alibaba has proposed to help 1stdibs’ efforts in Asia, where the company is eyeing a growing number of individual Chinese buyers. As China’s wealthy luxury shoppers become more focused on individualism, the concept of high-end vintage is slowly cropping up with the opening of new vintage boutiques and promotion of vintage car culture. Alibaba clearly sees potential for luxury vintage in China, stating that 1stdibs has “a great vision and strong sense of mission for their company.”

Source: Jing Daily

China E-Commerce

Alibaba revenues surge in Q3 2013

The total revenue of China's largest e-commerce company Alibaba Group rose 51 percent to US$1.78 billion in the third quarter last year as it continues its expansion in the online shopping sector. Profit in the three months up to September 30 added 12 percent from the previous quarter to reach US$800 million, according to a stock exchange filing by Yahoo, which holds a 24 percent stake in Alibaba Group. Last year, Alibaba Group made a string of investments to boost its presence outside the e-commerce sector. Alibaba paid US$586 million for an 18 percent stake in Sina Weibo, the Twitter-like microblog service, to boost social commerce income. It also has been pushing forward on mobile payment services through Alipay, the third-party payment service affiliated with the group, to tap the growing demand of consumers to browse and purchase from smart devices. On November 11, during the Singles' Day shopping spree in China, when vendors offered a 50 percent discount, transactions reached a record 35 billion yuan (US$5.77 billion) on Alibaba's Tmall and Taobao platforms.

Source: Shanghai Daily

Mon

27

Jan

2014

Daily Digital Pulse of China

China Digital

The Online Shopping Landscape in China Drives New Challenges For Companies

It is not a secret to anyone that Chinese consumers are searching to buy quality goods at higher prices and use social media to gather product information. According to a new report by The American Chamber of Commerce in Shanghai (AmCham Shanghai), in Tier-1 and Tier-2 cities, an increasing number of consumers are relying on consistency and integrity in their purchasing choices, a large change from a previously price driven market. This change signals greatly required alterations by both Chinese and International consumer brands with regard to the marketing channels they use and most importantly the content they drive in China. As a result of this the report details that with the increased usage of e-commerce and social media, the second most significant trend detailed in the report stated that both multinational and Chinese companies recognize the importance of developing digital marketing and sales channels. However, most companies declared that they are yet to be adequately prepared to convert growing online interactions to a sales advantage. The report, however, noted that leaders in this area demonstrate the benefits of strategic use of data derived from online viewing and purchasing habits and from this have displayed desirable results through alignment of digital activities with their corporate strategies and across organizational functions. For many large companies in their current situation this gives them the opportunity to build products and brands that can deliver great value. Experts are confident that this trend will increase brand loyalty among consumers focused on value which means that they will pay higher prices for quality products and services. Still to get to the sales conversion point consumer companies face large challenges in online retailing in this dynamic market.

Source: Retail In Asia

China Digital

Baidu Acquires Nuomi

Baidu has struck up an agreement with Renren to buy, in its entirety, the e-commerce site Nuomi. China’s number 1 search engine will become the platform’s exclusive investor and only shareholder. Baidu has made this move because it feels good about China’s massive local service industry market.

Source: Want China Times

China Digital

Baidu has Invested $15 million in a U.S. E-commerce Luxury Site

1stdibs, a New York-based retailer for upscale interior design, decoration, and fashion, has just received $15 million in series C funding from Alibaba. One-third of the platform’s business comes from outside the U.S., and will help Alibaba better serve China’s quickly-growing consumer market for luxury goods.

Source: Tech In Asia

Wed

15

Jan

2014

Daily Digital Pulse of China: Online Spending

China Digital

China is Spending More and More Online

With the people of Guangdong province leading the way, China’s online spending keeps on increasing. The latest data from Alipay tells us that the nation’s per capita online transactions, which incloude shopping, money transfers, and bill payments, came out to over 10,000 RMB (US $1,642) last year. Spending in Guangdong accounted for 16% of 2012’s online spending. As a whole, the spending of tier-1 cities is the greatest, but Alipay has also noted that smaller cities were not to be ignored. For example, shoppers in Yiwu (Zhejiang province), spent an average of 40,000 RMB ($6,569USD) last year, which is more than twice the amount of the average in Beijing. Alipay’s list of top 100 small cities and counties, 36 belonged to Zhejiang province, 27 from Jiangsu, and 13 from Fujian. Shoppers who spent over 1 million yuan ($164,219 USD) were from Yiwu and Cangnan counties, in Zhejiang province, and Changshu, located in Jiangsu province. Analysts have said that although those in lower-tier cities may have lower income than those in higher-tier ones, due to lower living costs, they may actually have as much or even more disposable income to spend online.

Source:ZD Net

China Digital

Internet Finance

Chinese Internet and e-commerce giants are transforming the country’s financial industry. Internet powerhouses have begun introducing financial products for their customers. The most notable financial product to date is Alibaba’s Yu’E Bao. Yu’E Bao is a money market fund where users can place their savings. This fund is invested and is currently earning interest that is greater than any of China’s banks – around 7%. At the end of last year, Yu’E Bao had 43.04 million users with a collective deposit of $30.4 billion US dollars. This value makes Yu’E Bao the largest single public fund in China. Consumers can access this fund with as little as 1 Yuan, thus highlighting the spirit of the Internet – being open with a bottom up approach. These types of funds are gaining popularity amongst consumers as the government has a strong grip on interest rates. In October, Baidu announced its online wealth management product Baifa and NetEase released Tianjin.

Source:Want China Times

Fri

10

Jan

2014

Daily Digital Pulse of China: Telecom, Tencent

China Digital

Tencent’s Micro Cloud

Tencent has released news of its upcoming 2.0 version of its Micro Cloud storage service. The new version will give the user several new features that convert the experience from an integration service to a storage one. This new version is expected to be available on January 15th. The cloud service now has 300 million users, a milestone reached just seven months after it hit the 100 million user mark in May of 2013. Users can now save websites, files, and notes and will be able to sync everything across multiple devices. The service will also be implementing integration into other Tencent products, such as QQ Offline Transmission, QQ Mail, QQ Album, and more. Tencent also wants to have the cloud service pre-installed into devices like smart phones and wearable ones.

Source:Tech Node

China Digital

Tencent’s Micro Cloud

The Chinese government is now issuing mobile virtual network operator licenses, and Alibaba’s subsidiary company, HiChina, and also JD.com have obtained them. What does having these licenses mean? The companies can now lease mobile services from the three state-run carriers but can offer their own packages with data and discounts. As of right now, 11 firms have received these licenses. JD.com hopes to become the country’s fourth-largest mobile carrier within the next half decade. This move will likely result in more mobile shoppers for the companies’ e-commerce platforms.

Source:The Next Web

China Digital

Bitcoin Value Drops 15% After Taobao Decision

Bitcoin shares have fallen by 15% in a single day. This drop in price came almost immediately after Taobao announced that it is placing an official ban on use of bitcoin effective January 14. The e-commerce platform also announced that it would ban certain bitcoin accessories, such as computer hardware and software for bitcoin mining. Industry insiders believe that as long as bitcoin in still available on other major platforms, Taobao’s decision will not affect the price too much in the long term. Bitcoin’s value fluctuated immensely throughout 2013. The digital currency was worth $13 US in early 2013, with the price reaching as high as $1200 US later in the year. Bitcoin’s current value is approximately $780 US.

Source:Want China Times

Thu

09

Jan

2014

Daily Digital Pulse of China: e-commerce, Taobao, Bitcoin, Alibaba

China Digital

Alibaba Bans Bitcoin

China’s largest online marketplace will ban the sale of bitcoin on its Taobao platform. This decision is partly due to the announcement by China’s Government that it is cracking down on the virtual currency as a form of legitimate payment. As the digital currency can be used for unlawful capital flows, many financial institutions are turning their backs on bitcoin. Taobao is also banning the sale of any guides, computer hardware or software relating to bitcoin ‘mining’. Another one of the key reasons why Alibaba Group has made this strategic decision is because the company is planning a giant public offering of stock and wants the smoothest transition as possible – a move that is conservatively estimated to be worth over $100 billion.

Source:Reuters

Wed

08

Jan

2014

Daily Digital Pulse of China: Alibaba, Sina, B2C E-Commerce, Social Media apps.

China Digital

Alibaba and Mobile Gaming

Mobile gaming, an industry worth 11.2 billion RMB in 2013, has become huge in China, and Alibaba wants a piece. This coming Wednesday, the Internet super company will be making its first foray into the world of mobile games. Historically, Alibaba has largely been a PC-oriented company, but has been making big efforts to make its name in the mobile sector as well. Along with Laiwang, its mobile messaging app, and Alipay wallet, its mobile e-payment app, Alibaba will be covering all bases after releasing mobile games. For those who are curious, Alibaba will be implementing a 7:2:1 revenue sharing model – with 70% going to developers, 20% going to Alibaba, and 10% going to charity.

Source:Alizila

China Digital

China Social Sharing Apps Used In Travel

Sina Weibo and Wechat ranked first and second in social sharing networks for travel, with 81.7% and 72.9% respectively. Of those that used social media while traveling, 85.1% shared photos of their travels, 68.1% shared statuses of how they were feeling and 46.8% shared information about their travel location. While traveling the most used mobile app map was the Baidu map with 39.6%, followed by Autonavi with 18.8%. 47.7% of Chinese consumers chose their mobile map app based on the fact it was straightforward to operate and user-friendly. 31.8% choose the map app due to the fact the app could offer all-round daily life service.

Source:China Internet Watch

China Digital

Microblogging + Alipay

Sina and Alibaba have teamed up to open joint microblogging Alipay accounts. Previously, customers had to log into their Alipay accounts separately after making a purchase on Weibo, but that hassle is no longer necessary. After transactions have been made, customers can communicate with sellers and share their purchases on their microblogs.

Source:IT Feed

China Digital

Shanghai Launched Cross- Border B2C E-Commerce Platform in FTZ

Shanghai Free Trade Zone officially launched cross border e-commerce platform kuajingtong.com on December 28, 2013. It is the first e-commerce enterprise granted by Chinese government. Kuajingtong aims at becoming the official and standard cross-border e-commerce platform in China. The site is supported by Shanghai customs, and has the advantages of product authentication guarantee, competitive pricing, transparent taxes, convenient logistics and customer service. Kuajingtong overseas products only require 50% custom duty, while normally other enterprises have to pay 150%. The company has contacted about 20 international B2C enterprises’ and plans to become the portal site of china cross border e-commerce.

Source:China Internet Watch

China Digital

China’s Telecommunication Services For Sale