Fri

29

Apr

2022

ALDI Shanghai grocery care packages delivered during ongoing China Covid lockdowns

Last week we were very fortunate to be able to organize a care package for Web2Asia employees and our esteemed clients located in Shanghai. A huge thank you to ALDI CHINA and to the head of our food & beverage department for coordinating this effort – close to 200 packages were delivered during ongoing lockdowns in almost all parts of Shanghai was not an easy feat. Vegetables are increasingly provided by district governments, so we decided on a premium selection of protein and carbohydrates to boost everyone’s spirit – 加油上海!

Sun

20

Jun

2021

New Record set for 2021 June 18 mid-year shopping festival

2021 China June 18 6.18 E-Commerce Shopping Festival on Alibaba TMall, Tmall Global, JingDong JD and JD Worldwide

Wed

11

Nov

2020

Web2Asia client Uncle Buds launches its CBD brand on Tmall Global with Magic Johnson livestream!

US American brand Uncle Bud's is not only the first Western CBD producer to enter China (Forbes reports here) through China cross-border e-commerce but did so with a bang: during the largest shopping event of the year November 11th Singles Day Uncle Bud's brand ambassador, the legend Magic Johnson himself, participated in a live stream together with prominent Chinese KOL bbgilian.

Mon

13

Jul

2020

Web2Asia once more awarded 5 Star Tmall Partner by Tmall Global

Web2Asia has been awarded 5 Star Tmall Partner (TP) by Tmall Global for the year 2020. This is the highest certification level for Alibaba Partners. We are extremely thankful for our clients' and Alibabas' trust to allow this recognition.

Mon

13

Jan

2020

Web2Asia client ALDI wins ele.me Fastest Growing Merchant Award 2019

China "New Retail" E-Commerce done right:

Mon

02

Dec

2019

Web2Asia awarded TOP 3 Tmall Partner by Tmall Global during 11.11. Singles Day 2019

Web2Asia has been awarded the Top 3 Tmall Partner (TP) by Tmall Global during 11.11. Singles Day 2019 for the food and grocery category. Thank you to all our clients who cooperate with us on the cross-border e-commerce platform! 名趣商务 is Web2Asia's Chinese representation in Shanghai.

Tue

18

Dec

2018

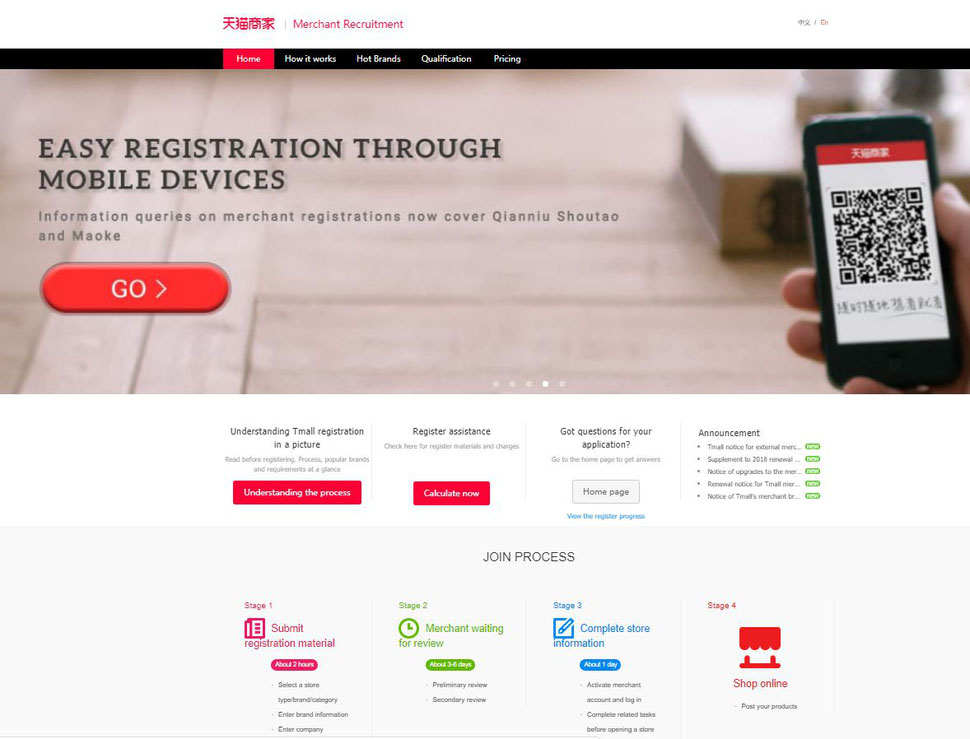

Tmall Store Registration Process now available in English

The entire Tmall store opening process for Tmall domestic and Tmall Global is now fully available in English language at https://pages.tmall.com/wow/seller/act/zhaoshang-en?spm=a223k.11631944.6107009570.4.bb7f4615uUtzAn&wh_language=en-US&acm=lb-zebra-14053-462070.1003.4.557679&scm=1003.4.lb-zebra-14053-462070.OTHER_14472755973720_557679

Also please remember that Tmall is an invitation-only platform. The list of invited brands is now also available in English here: https://pages.tmall.com/wow/seller/act/sellerbrand-en?spm=a223k.11633127.6107009570.6.1b5b401bNCP95R&wh_language=en-US&acm=lb-zebra-14053-462070.1003.4.557679&scm=1003.4.lb-zebra-14053-462070.OTHER_14472752126241_557679

Thu

22

Mar

2018

March 22nd 2018 News: dm drogerie markt Tmall Global shop recognized as the 2017 Super Brand

One year after the launch dm-deguo-tmall.hk our client dm drogerie markt has been recognized as the 2017 Super Brand on Tmall Global and for setting new trends in the industry. The dm shop is also in the exclusive 100m+ club which is an award presented by Alibaba to all Tmall Global stores that generate more than 100mil RMB annual GMV. This is a fantastic result given that the store is only one year old. All credit goes to the hardworking teams at dm, our partner agency oddity, Alibaba and Web2Asia!

The award ceremony was held at the annual Alibaba Tmall Global TG100 Partner Summit 2018 in Hangzhou.

Sat

22

Jul

2017

Alibaba produces Jellycat & Web2Asia Tmall Global success case study video

Watch how Web2Asia is helping British toy brand Jellycat with its flagship store at jellycat.tmall.hk to sell via cross-border E-Commerce directly to Chinese consumers. Jellycat has now achieved no 1 position in the entire Alibaba Tmall and Taobao plush toy category. This case study video on Jellycat's succes on Tmall Global was produced and published by Alibaba Group at http://www.alizila.com/video/worlds-squidgiest-toy-comes-china/.

Wed

19

Apr

2017

Web2Asia attends 2017 Alibaba Global Partners Summit with 5 key account clients, wins award for Hansgrohe top brand of 2016

Our team attended the Alibaba 2017 Global Partners Summit in Hangzhou this April 18th 2017.

The event was a high level gathering of only C-Suite level representatives from Tmall Global key account brand clients and Tmall Partners ("TP's") respectively.

Web2Asia attended as Tmall Partner, representing five of it's Tmall Global key account clients:

- Hansgrohe

- dm-drogerie markt

- Jellycat

- Bellroy

- METRO Group

Congratulations go to our client Hansgrohe for winning the most popular brand of 2016 award. Pictured to the left is Web2Asia CEO George Godula and Thomas Stopper who is responsible for all E-Commerce, Sales and Finance for Hansgrohe in Mainland China and Macao.

Below a picture gallery with further impressions from the event. Pictured are among others Alvin Liu, CEO Tmall Global, representatives from METRO, jellycat and dm-drogerie markt.

Mon

06

Mar

2017

Web2Asia launches dm-drogerie markt on Alibaba Tmall Global

Today marks the flagship store Grand Opening of German drug store dm-drogerie markt on Alibaba's Tmall Global platform. Web2Asia worked for over one year in preparation of the launch together with dm, it's German agency oddity as well as Alibaba Tmall and Cainiao. Already in the soft-launch phase from December 2016 to February 2017 the flagship store became the largest German drug store on Tmall in terms of monthly Gross Merchandise Volume (GMV).

The store currently features dm's private label brands Balea, DONTODENT, Prinzessin Sternenzauber and DAS gesunde PLUS in the categories of cosmetics, dental care as well as children's personal care and health supplements respectively. dm is also one of total only three officially authorized resellers of Aptamil instant formula, which now is also made available to Chinese consumers via cross-border E-Commerce and with highest German quality standards.

About dm-drogerie markt

dm-drogerie markt is a chain of retail stores headquartered in Karlsruhe, Germany that sells cosmetics, healthcare items, household products and health food. With 38,890 employees, 1,825 stores and approx. 7.5 billion EUR in revenues in Germany, dm is Europe's largest retailer in the drug store category.

About Web2Asia

Web2Asia is an award winning China Digital Agency and E-Commerce Operation company. It works with foreign brand clients to setup shops on the major Chinese online marketplaces and maintain them with a full-service solution. Web2Asia is star-rated Tmall Partner ("TP") and recommended by Tmall Global.

Thu

02

Mar

2017

Goldman report: China Online Shopping to double in size to $1.7 trillion by 2020

Wed

01

Mar

2017

What is a Tmall Partner ("TP") Agency? (aka Tmall Trade Partner)

Web2Asia's CEO George Godula was recently featured by Alibaba on what Tmall Partners TP or so called Tmall Trade Partner are and how they can help foreign brands sell to Chinese consumers through E-Commerce online. All content (c) by Alibaba Group. The full Tmall Partner TP list can be found on Tmall.hk.

Fri

09

Oct

2015

China Daily Digital Pulse: Tmall Global to launch O2O offline retail stores

China E-Commerce

Tmall Global to launch O2O retail stores

Interesting developments in the China cross-border e-commerce market: Tmall Global will launch 23 offline stores in Hangzhou as an initial test run. The stores will offer a mix of approx. 70% immediately available imported products as well as 30% of inventory through O2O cross-border shipped foreign products. The offline retail expansion will be in cooperation with Chinese department store operator Intime Retail Group - one of Alibaba's 2014 investments into brick & mortar retailing.

Web2Asia is excited to have one of our clients participate in the first roll-out and are looking forward to sharing further updates.

Source: ebrun

Mon

21

Apr

2014

Daily Digital Pulse of China: Alibaba, Alipay, The Vatican, M-Commerce, and Weibo

China E-Commerce

Alibaba to Start Telecom Services in China

Alibaba, China’s biggest e-commerce group, will be launching Chinese telecom services in June. The company received China’s first mobile virtual network operating licenses late last year. The exact details of the services will remain under wraps, but it has been reported that Alibaba has coordinated with China’s major telecom companies – China Mobile, China Telecom, and China Unicom – to offer the ultimate services to millions of mobile users. Alibaba is actually among 11 companies approved by Chinese regulators to operate virtual network in China.

Source: Wall Street Journal

China E-Commerce

Alipay Moves Beyond Alibaba with Rakuten

Last week, Rakuten, one of the main e-commerce players in Japan, started accepting Alipay payments, making life much easier for Chinese consumers to take advantage of the Japanese international marketplace.

Rakuten’s Japanese marketplace is massive, with 42,000 sellers, while its international one (Rakuten Global) is still relatively small, with about 10,000 sellers. At this moment of time, only about 250 sellers on Rakuten Global accept Alipay, but eventually all Rakuten sellers who ship to China will be accepting Alipay.

Source: China Topix

China E-Commerce

The Vatican to go digital

A Japanese IT firm will work in tandem with NTT Data in order to ‘digitize’ the Vatican Library which was founded in 1451, and contains more than 82000 manuscripts, some of which are 1800 years old. The first round of documents is set to take 4 years, and will only cover 3000 documents. At the speed at which things are being done now it will take more than 100 years to digitize everything. The first sets of documents are set to be online by the end of 2014 and the documents are expected take up 43 quadrillion bytes of storage space, and will be backed up in case files are accidentally deleted or corrupted. The initial 4-year phase is expected to cost around $25 million, but NTT Data are hoping that some of their expenses will be compensated by donations made through the library’s website.

Source: Mashable

China E-Commerce

M-Commerce in China flies

Mobile commerce, commonly known as M-Commerce is in full swing, and the statistics show it. Sales are set to exceed $51 billion by the end of this year, with an average of 50% growth over the next 2 years, exceeding $115 Billion by 2016. Year on year, M-Commerce has grown 165.4% since 2012, however the trend is expected to slow as the market saturates. 69% of Chinese consumers have purchased a product through their Smartphone’s, compared to only 46% in the US. In terms of online mobile platforms, Taobao accounts for 76.1% of the market, and interestingly Amazon only accounts for 0.6%. On the Taobao platform, more than 80% of the purchases are made through Smartphone’s, and purchases take on average 67 seconds quicker than PCs. All these stat’s go to show just how big the M-Commerce market is, and how quickly it’s developing. It will be interesting to watch the rest of the world to see if they will follow this trend.

Source: Resonance China

China E-Commerce

Weibo’s low profile IPO

Sina Weibo – a Chinese micro-blogging website and effectively a hybrid of Facebook and Twitter, listed on the NASDAQ on Friday. Weibo has 143.8 million active users, which is significantly less than twitter’s 241 million. Weibo’s IPO was relatively subdued and conservative and when the shares actually debuted they were at a mere $16.27. Only 16.8 million of its 20 million shares were subscribed to. After the days close however, the shares were up to $20.24, a 24% increase. Weibo is now valued at $3.4 billion, and will be an interesting share to watch as it marks yet another social media platform going public.

Source: Tech In Asia

Tue

15

Apr

2014

Daily Digital Pulse of China: Online Shopping,

China E-Commerce

14% of Chinese Shop Online Everyday

According to a report created by PricewaterhouseCoopers, 14% of Chinese respondents shop online daily. Over 60% claim to shop online at least once a week, which is much higher than the global average of just 5% who shop online everyday and 21% every week. When it comes to mobile shopping, Chinese consumers ranked first, with 4% of respondents shopping via mobile everyday, 20% using it once a week, and 27% once a month. The global percentages are 2%, 7%, and 12%, respectively.

Source: China Internet Watch

China E-Commerce

Chinese online market revenue and mobile users increase exponentially

The Ministry of culture today released a report stating that the popularity of mobile Internet and more specifically online music increased remarkably. Market revenue of China’s online music business reached 7.41 Billion Yuan, an increase of 63.2% since 2012, while the online music market increased 140% to 4.36 Billion Yuan.

Of particular interest were the online user figures. The number of online users only increased by 4.6% to 450 million people, however the number of mobile music users grew 203% from 96 million to 291 million, highlighting the huge move towards mobile Internet usage. Although the report sounds promising there were still problems regarding network efficiency, which plagued the development of the music industry, but the Ministry of Culture has said they will focus on improving policies and regulations to progress the integrity and effectiveness of the system in order to promote continued prosperity and healthy development.

Source: Alibuybuy

China E-Commerce

China Overtakes the U.S. as the Biggest Online Spenders

The Chinese e-commerce industry is predicted to be worth $541 billion USD by the year 2015. In fact, 49% of the population made an online purchase last year, a figure that is meant to increase to 71% by 2017. The demographic of the Chinese online consumer is comprised primarily of younger people, with 60% of the consumers under the age of 30. They are also considered to be affluent – online spending is highest in China’s tier one cities, and those earning more than 5,000 RMB per month are likelier to make online purchases. The market is also dominated by mobile devices, with 464 million of its 591 million internet users opting to use their smartphones or mobile devices to surf the web.

Source: The Future of Commerce

China E-Commerce

LinkedIn attempts to enter Chinese Market

With LinkedIn making its entry into the Chinese market after many people were skeptical about the Western network getting over the countries great firewall, its greatest challenge lies in adapting to an entirely different culture. In comparison to the Western world, Chinese relationships are more private, and people keep their cards very close to their chest, which is the opposite of LinkedIn’s fundamental approach; publicly broadcasting one’s professional contacts.

Trying to change the mindset of an entire society will ultimately result in failure. LinkedIn is still in young in China, and is effectively seen as a startup but if it manages to adapt effectively and localize its use here, it may provide China’s young-up-and-comers with another professional social network in which to build relationships.

Source: Tech In Asia

Fri

11

Apr

2014

Daily Digital Pulse of China: WeChat, Cache-Cache & B2C

China Digital

WeChat adds image recognition feature which can benefit online-retailers

Since the release of the WeChat 5.0 version (launched in August last year) users could already learn more about a product like books or music albums by scanning the barcode on the cover or packaging and be redirected to the company website – and in some instances directly to the e-commerce sites for purchase.

This week WeChat released a new Image Recognition Feature. Now users no longer have to rely on barcodes but can simply scan a book cover and e.g. read reviews from Douban Book (a popular chinese platform for book ratings and reviews) or purchase the book directly from online retailer Dangdang.com. WeChat plans further enhancements to this service which is currently offered for free.

Source:Technode

Source:JingDaily

China E-Commerce

French Ready-To-Wear Brand Cache-Cache to accelerate it’s development in China E-Commerce.

As part of its development strategy in China, the French ready-to-wear brand Cache-Cache has decided to step on the accelerator for their investments in the Chinese e-commerce market. The brand has over 850 brick-and-mortar stores across the country and is already selling its products on Tmall. Cache-Cache is now considering to have its own platform of e-commerce to reclaim its online business in order to support its omni-channel strategy based on web-to-store. Online sales should allow the brand an annual growth of 30%.

Source: Les échos de la franchise

China E-Commerce

China’s B2C Industry Rapidly Gains Market Share

Despite both platform types growing at double-digit rates, it seems as though Chinese online consumers are increasingly turning towards business-to-consumer platforms over consumer-to-consumer ones to satisfy their online shopping desires. C2C platform sales accounted for nearly two-thirds of all Chinese online retail sales in 2013, but it has been predicted that the B2C sector would overtake the C2C one by 2017, as its growth rate is twice as fast. Why the rapid growth rate for B2C platforms? Shoppers have grown to prefer the higher quality and service of official flagship shops. It isn’t a matter of Taobao, China’s most popular C2C marketplace, performing poorly – it is simply due to the fact that there is more and more competition in an area where there wasn’t any for quite a while. The number of C2C e-tailers has actually decreased by 17.8% year on year from 2012 to 2013, and it is estimated to fall even further to just 9.18 million by the end of this year.

Source: iResearch China

Thu

10

Apr

2014

Daily Digital Pulse of China: Mobile Internet

China E-Commerce

China’s Mobile Internet Industry

China’s Internet industry has taken a turn to focusing on monetizing the smart phone market. Companies are gradually shifting their businesses from PC to mobile due to high mobile phone penetration rates in the country. Mobile phone penetration is nearly at 100%, and the majority of the aforementioned commoditization is coming from the increasingly popular, lower-cost, domestically produced smart phones, particularly within rural areas. Monetization for the industry is primarily coming from mobile gaming, e-commerce, and new forms of mobile payments.

At the end of 2013, Chinese mobile phone users exceeded one billion, with over half of them being smart phone users. It has been estimated that the smart phone penetration rate in China will reach or even exceed 90% by the end of this year. Despite this prediction, foreign smart phone shipments to China in the 4th quarter of 2013 decreased by 4.3%, quarter-on-quarter, the first drop since the 2nd quarter of 2011. This is mostly because of the attractive prices of domestic brand phones, such as Lenovo, Xiaomi, and Coolpad, (which typically go for less than half the price of an Apple iPhone). The average purchase price of a smart phone in China actually dropped from 2,321 RMB in 2011 to 1,773 RMB (US$286) in 2013.

The availability of these new, affordable smart phones allows for residents of rural areas to be able to access the Internet for the first time. It has been reported that 62% of mobile Internet users earn less than 4,000 RMB per month, with migrant workers making up a significant part of this total. The Chinese government, however, has plans to help rural areas catch up to the more affluent cities by aiming to achieve 85% fixed broadband penetration and 95% 3G/4G user penetration by 2020.

With smart phone penetration on the rise, mobile e-commerce is growing rapidly. Online transactions in China reached 1.9 billion RMB in 2013, making up 7.8% of total retail sales in the country. The mobile shopping industry’s total transaction value grew by 165% to 168 billion RMB, nabbing 9% of the total online shopping industry, as compared to just 4.8% in 2012. It has been estimated that it will eventually reached one trillion RMB by 2017.

Besides smart phone penetration getting so high, what else is contributing to the growing rates of mobile shopping? The big e-commerce platforms are heavily promoting mobile shopping by providing discounts to those making purchases via their mobile devices. Also, people are increasingly choosing to spend the little free time they have to shopping through their mobile devices instead of stepping foot in shopping malls.

Source: Fidelity

Wed

09

Apr

2014

Daily Digital Pulse of China: Jingdong

China E-Commerce

JD.com to Develop its O2O Model

Jingdong has signed with about 10,000 Chinese convenience stores to establish an innovative online-to-offline retail plan. These 10,000 convenience stores will cover 15 cities, and will include brands like Quik, Good Neighbors, Buddies, C&U, and Meijiya. The deals will let Chinese customers buy items online and have them delivered or be picked up at physical locations. It will also let them use online payment methods at the brick-and-mortar stores themselves.

Source: China Tech News

China E-Commerce

JD.com to take a Leap into the Chinese Virtual Communications Industry

JD.com will be launching JD Mobile this May, which will include both products and numbers. JD.com recently revealed the brand logo and a sample SIM card designed for the line. The new logo will have Joy, JD.com’s mascot dog on it, representing a link between the parent company and this new one.

Source: China Tech News